Holding Company Tax Form . the answer may change if the holding company actually does something other than just owning another entity that. understanding how to properly file irs forms and schedules related to personal holding company (phc) tax can be. a personal holding company (phc) is known as a c corporation formed for the purpose of owning the stock of other companies;. the phc tax is a 20% tax imposed for each tax year on a phc's undistributed personal holding company. alternatively, the profits, losses, and tax liabilities of subsidiaries regarded as disregarded entities (e.g.,. Use schedule ph to figure the personal holding company (phc) tax. a holding company can be either a c corporation or an llc, but, if the holding is set up as an llc and its subsidiary is a c corporation, the irs will.

from www.formsbank.com

the phc tax is a 20% tax imposed for each tax year on a phc's undistributed personal holding company. a holding company can be either a c corporation or an llc, but, if the holding is set up as an llc and its subsidiary is a c corporation, the irs will. alternatively, the profits, losses, and tax liabilities of subsidiaries regarded as disregarded entities (e.g.,. understanding how to properly file irs forms and schedules related to personal holding company (phc) tax can be. a personal holding company (phc) is known as a c corporation formed for the purpose of owning the stock of other companies;. the answer may change if the holding company actually does something other than just owning another entity that. Use schedule ph to figure the personal holding company (phc) tax.

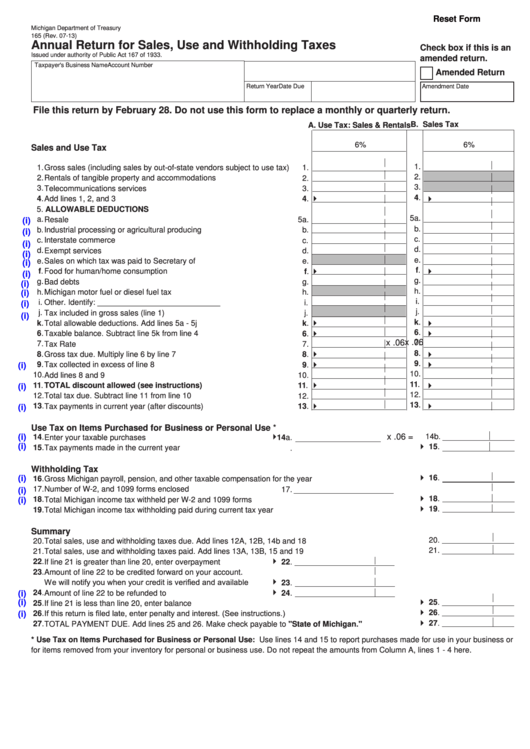

Fillable Form 165 Annual Return For Sales, Use And Withholding Taxes printable pdf download

Holding Company Tax Form understanding how to properly file irs forms and schedules related to personal holding company (phc) tax can be. a holding company can be either a c corporation or an llc, but, if the holding is set up as an llc and its subsidiary is a c corporation, the irs will. Use schedule ph to figure the personal holding company (phc) tax. understanding how to properly file irs forms and schedules related to personal holding company (phc) tax can be. alternatively, the profits, losses, and tax liabilities of subsidiaries regarded as disregarded entities (e.g.,. a personal holding company (phc) is known as a c corporation formed for the purpose of owning the stock of other companies;. the phc tax is a 20% tax imposed for each tax year on a phc's undistributed personal holding company. the answer may change if the holding company actually does something other than just owning another entity that.

From growthlab.com

LLC tax filing What you need to know as a solo entrepreneur GrowthLab Holding Company Tax Form the phc tax is a 20% tax imposed for each tax year on a phc's undistributed personal holding company. a personal holding company (phc) is known as a c corporation formed for the purpose of owning the stock of other companies;. understanding how to properly file irs forms and schedules related to personal holding company (phc) tax. Holding Company Tax Form.

From www.youtube.com

Personal Holding Company Taxes Schedule PH Form 1120 YouTube Holding Company Tax Form understanding how to properly file irs forms and schedules related to personal holding company (phc) tax can be. the answer may change if the holding company actually does something other than just owning another entity that. a holding company can be either a c corporation or an llc, but, if the holding is set up as an. Holding Company Tax Form.

From www.wordtemplatesonline.net

15+ Free Acknowledgement Receipt Templates (Samples) Holding Company Tax Form the answer may change if the holding company actually does something other than just owning another entity that. the phc tax is a 20% tax imposed for each tax year on a phc's undistributed personal holding company. a holding company can be either a c corporation or an llc, but, if the holding is set up as. Holding Company Tax Form.

From www.templateroller.com

Form 1902AP Fill Out, Sign Online and Download Printable PDF, Delaware Templateroller Holding Company Tax Form a personal holding company (phc) is known as a c corporation formed for the purpose of owning the stock of other companies;. understanding how to properly file irs forms and schedules related to personal holding company (phc) tax can be. alternatively, the profits, losses, and tax liabilities of subsidiaries regarded as disregarded entities (e.g.,. the phc. Holding Company Tax Form.

From www.signnow.com

Illinois with Holding Tax Return Wiki Form Fill Out and Sign Printable PDF Template Holding Company Tax Form the phc tax is a 20% tax imposed for each tax year on a phc's undistributed personal holding company. a holding company can be either a c corporation or an llc, but, if the holding is set up as an llc and its subsidiary is a c corporation, the irs will. understanding how to properly file irs. Holding Company Tax Form.

From blog.fresatechnologies.com

Steps to Calculate With Holding Tax on the Invoice Holding Company Tax Form a holding company can be either a c corporation or an llc, but, if the holding is set up as an llc and its subsidiary is a c corporation, the irs will. understanding how to properly file irs forms and schedules related to personal holding company (phc) tax can be. Use schedule ph to figure the personal holding. Holding Company Tax Form.

From www.alamy.com

hand holding simple tax form with phone Stock Vector Image & Art Alamy Holding Company Tax Form a holding company can be either a c corporation or an llc, but, if the holding is set up as an llc and its subsidiary is a c corporation, the irs will. understanding how to properly file irs forms and schedules related to personal holding company (phc) tax can be. a personal holding company (phc) is known. Holding Company Tax Form.

From www.employeeform.net

Employee's Withholding Allowance Certificate Form 2022 2024 Holding Company Tax Form a personal holding company (phc) is known as a c corporation formed for the purpose of owning the stock of other companies;. alternatively, the profits, losses, and tax liabilities of subsidiaries regarded as disregarded entities (e.g.,. Use schedule ph to figure the personal holding company (phc) tax. the phc tax is a 20% tax imposed for each. Holding Company Tax Form.

From studylib.net

Basic Format of Tax Computation for an Investment Holding Company Holding Company Tax Form a holding company can be either a c corporation or an llc, but, if the holding is set up as an llc and its subsidiary is a c corporation, the irs will. alternatively, the profits, losses, and tax liabilities of subsidiaries regarded as disregarded entities (e.g.,. the answer may change if the holding company actually does something. Holding Company Tax Form.

From www.alamy.com

thin line hand holding tax form Stock Vector Image & Art Alamy Holding Company Tax Form the answer may change if the holding company actually does something other than just owning another entity that. understanding how to properly file irs forms and schedules related to personal holding company (phc) tax can be. the phc tax is a 20% tax imposed for each tax year on a phc's undistributed personal holding company. alternatively,. Holding Company Tax Form.

From www.alamy.com

black hand holding thin line tax form Stock Vector Image & Art Alamy Holding Company Tax Form understanding how to properly file irs forms and schedules related to personal holding company (phc) tax can be. a personal holding company (phc) is known as a c corporation formed for the purpose of owning the stock of other companies;. a holding company can be either a c corporation or an llc, but, if the holding is. Holding Company Tax Form.

From printableformsfree.com

2023 Ca Withholding Form Printable Forms Free Online Holding Company Tax Form alternatively, the profits, losses, and tax liabilities of subsidiaries regarded as disregarded entities (e.g.,. understanding how to properly file irs forms and schedules related to personal holding company (phc) tax can be. the answer may change if the holding company actually does something other than just owning another entity that. a holding company can be either. Holding Company Tax Form.

From www.uslegalforms.com

Forms For Tax Withholding Fill and Sign Printable Template Online US Legal Forms Holding Company Tax Form Use schedule ph to figure the personal holding company (phc) tax. understanding how to properly file irs forms and schedules related to personal holding company (phc) tax can be. the answer may change if the holding company actually does something other than just owning another entity that. the phc tax is a 20% tax imposed for each. Holding Company Tax Form.

From www.dreamstime.com

Cartoon Businessman Holding Tax Form Stock Vector Illustration of holding, employee 146530910 Holding Company Tax Form Use schedule ph to figure the personal holding company (phc) tax. the answer may change if the holding company actually does something other than just owning another entity that. the phc tax is a 20% tax imposed for each tax year on a phc's undistributed personal holding company. a personal holding company (phc) is known as a. Holding Company Tax Form.

From www.formsbirds.com

Form 1120 (Schedule PH) U.S. Personal Holding Company Tax (2013) Free Download Holding Company Tax Form alternatively, the profits, losses, and tax liabilities of subsidiaries regarded as disregarded entities (e.g.,. a holding company can be either a c corporation or an llc, but, if the holding is set up as an llc and its subsidiary is a c corporation, the irs will. understanding how to properly file irs forms and schedules related to. Holding Company Tax Form.

From www.formsbank.com

Fillable Form 165 Annual Return For Sales, Use And Withholding Taxes printable pdf download Holding Company Tax Form the answer may change if the holding company actually does something other than just owning another entity that. understanding how to properly file irs forms and schedules related to personal holding company (phc) tax can be. a holding company can be either a c corporation or an llc, but, if the holding is set up as an. Holding Company Tax Form.

From www.freepik.com

Premium Vector Hand holding tax form and money flat design vector illustration Holding Company Tax Form the answer may change if the holding company actually does something other than just owning another entity that. the phc tax is a 20% tax imposed for each tax year on a phc's undistributed personal holding company. a holding company can be either a c corporation or an llc, but, if the holding is set up as. Holding Company Tax Form.

From www.alamy.com

Man holding US tax form W9. Tax form law document irs business concept Stock Photo Alamy Holding Company Tax Form the phc tax is a 20% tax imposed for each tax year on a phc's undistributed personal holding company. the answer may change if the holding company actually does something other than just owning another entity that. understanding how to properly file irs forms and schedules related to personal holding company (phc) tax can be. Use schedule. Holding Company Tax Form.